Business Checking Promotion

February 1st – May 31st

Get more from your business checking account. No matter how big (or small) your business is, your local Security State Bank is here to help you with the tools you need to run and grow your business at any point in your financial journey. We are your one stop shop for all your business’s needs. Let’s get to work.

Monthly business checking account service charge will be waived for 12 months when you sign up for merchant credit card processing.

This offer includes:

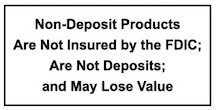

| • No cost merchant analysis – Submit here • Small business intro binder check package • Business credit card * • Free Night Drop Services • Debit card rewards* • Business Online Banking/Cash Management* (initial set up fee waived) • IntraFi- Additional FDIC for large deposits |

|

Explore other business banking products and services:

Give us a call at one of our locations to learn more.

Submit two current credit card statements for a free analysis and our merchant service team will reach out to you to discuss potential savings. Learn more about Basys Processing.

Only non-interest-bearing business checking accounts qualify for this promotion and require a minimum deposit of $500 to open. No minimum balance required to avoid a monthly service charge. Business credit cards are available upon underwriting and approval through United Bankers Bank. An $8.00 business checking monthly service charge will be waived for one year with the submission and approval of a merchant processing contract for a new merchant processing account of any size by May 31,2025. The waived service charge for this promotion will be effective starting the month the account is opened. If the merchant application is not approved, the service charge will not be waived for the first year. Merchant processing services are available for new and existing credit card merchant processing customers and are approved by Basys Processing. Merchants that currently accept credit cards must be willing to provide a minimum of two current merchant statements for review. The initial set up fee of $50.00 for all new Cash Management accounts will be waived at the time of account opening for new and existing customers during the promotion period. The uChoose Rewards Program is available to open on active accounts designated by Security State Bank. The uChoose debit cards rewards require enrollment to participate in the program. uChoose Rewards is not an affiliate of Security State Bank. For Program information, click the “Terms and Conditions” link at uChooseRewards.com.