Personal Accounts

Personal accounts for everyone. Security State Bank offers a variety of accounts for the way you like to bank. We know that everyone has different financial needs, but everyone enjoys simple and rewarding accounts. Our knowledgeable and friendly staff will work with you to make sure all of your banking needs are met so you can spend less time worrying about your finances and more time enjoying life.

Existing customers please click “Online Banking” to open your new account through the online banking portal. If you do not have an online banking login, please click “Enroll Now” to register for a login and open your account.

If you are not a current Security State Bank customer, please click “Here” to open your account.

Personal Checking

Features: ($50 minimum to open)

Security State Bank offers a deposit product that incents our customers for utilizing electronic transactions. To obtain more information or open an account, stop by one of our convenient locations.

- Earn a competitive interest rate on average daily balances over $500

- Use your debit card or set up a monthly electronic transaction to avoid your monthly statement fee

Senior Account

Features: ($50 minimum to open)

Enjoy an interest bearing account with all the extra benefits – you’ve earned it!

- If you are 60 or over Senior Checking includes added value with no fees

- No monthly service charges

- Free check images in statement

- No charge for ATM or Visa Check Card

- Free bank specialty checks in duplicate or wallet

- Earns interest on any balance

Money Market Checking

Features: ($2000 minimum to open)

A Tiered interest-bearing account that offers immediate access to funds and check writing capabilities while earning a competitive rate on balances.

- Earn interest at competitive rates and enjoy the benefits of checking

- Minimum balance of $2000

- Monthly withdrawal limitations apply

- Interest rate varies on average monthly balances

Basic Savings

Features: ($50 minimum to open)

It’s never too late to start planning for your future. Security State Bank has a savings option to help you effectively manage your money, while still providing you with all the financial freedom to enjoy life as you go.

- Hassle free account to meet your basic savings needs

- Free ATM card available

- Monthly withdrawal limitations apply

- Minimum balance of $50

- Free Mobile Banking

- Free 24 hour Telephone Banking

- Free Online Banking and Bill Pay[1]

Transfer The Cents

Features:

Allows you to round up debit card purchases from your checking account to the next whole dollar amount and transfer the difference to the savings or checking account of your choice. 3 Reasons to Save with Transfer the Cents

- Save time, money and stress

- The more you shop, the more your save

- Everything is automatic-so saving is effortless

Health Savings Account

Features: ($100 minimum to open)

Need help with healthcare costs? At Security State Bank your financial health is our goal.

- Save for future medical expenses for you and your family

- Offers tax advantages

- Avoid monthly statement fees by signing up for E-Statements

- Free HSA debit card available

- Free Mobile Banking

- Rolls over year after year

- Free Online Banking and Bill Pay[1]

- Free 24 hour telephone banking

Student Checking

Features: ($50 minimum to open)

Security State Bank offers a student account tailored to fit a student’s needs. Stress free, Convenient Banking for students under 24.

- Free Mobile Banking

- Free Online Banking and Bill Pay[1]

- Free 24 hour Telephone Banking

- Free ATM/Debit Card[2]

- Mobile Deposit

- Apple Pay, Android Pay, Samsung Pay

- (4) Foreign ATM Fees waived each statement cycle

Minor Savings

Features: ($25 minimum to open)

It’s never too late to start teaching your children about the value of money and the importance of savings. Security State Bank believes that learning at a yourng age about money can help build a foundation for good financial habits in the future.

- For children under (24) years

- No monthly service charge

- Earns interest

- Monthly withdrawal limitations apply

- Watch their savings grow with Free Online Banking

- Free Mobile Banking

- Free Online Banking and Bill Pay[1]

- Free Telephone Banking

- Free ATM Cards available

- Custodial accounts options available

Christmas Club

Features: ($50 minimum to open)

A Security State Bank Christmas Club account is a great way to save for your holiday expenses. Holiday saving should not be limited to buying gifts, but also for traveling, hosting parties and other upcoming expenses that may end up costing you more if you have to make monthly payments to your credit card provider to payoff expenses.

- No monthly service fee

- Yield is calculated on the minimum average daily balance of $1,000

- Our Christmas Club gives you the unique flexibility to choose any amount you wish to save for the holidays up to $6,000

- Any deposit over the $6,000 or additional customer withdrawals will result in the account automatically converting to a Basic Savings account rate

- Withdrawals are limited to one per year (disbursement of funds in November)

- Funds are disbursed via check or ACH deposit issued to the primary account owner on or about the 15th of every November

To see our current rates, Click Here.

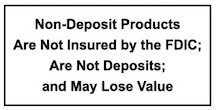

To learn more about FDIC Insurance, Click Here.

Switch your Accounts to Security State Bank. It’s quick and easy with our Switch Kit.

If you need to reorder checks use our secure Check Reorder Form.

[1] Inactivity Fee May Apply

[2] Applicable Fees May Apply

[3] Minimum average daily balance of $1,000 to earn quoted APY. Must have an existing account or a new account with direct deposit to open. Interest rate changed annually. Account will automatically change to a regular savings and will earn the current regular savings rate if missed deposits or early withdrawals occur. Maximum deposit $500 per month.